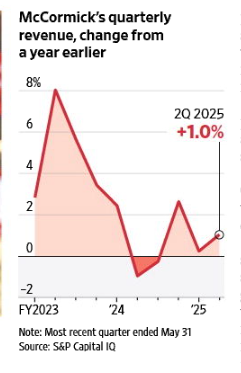

McCormick & Company, Incorporated MKC reported second-quarter fiscal 2025 results, with the top line increasing year over year.

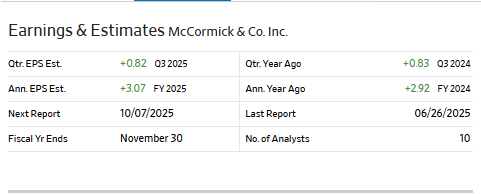

The adjusted earnings of 69 cents per share were unchanged from the year-ago quarter.

The metric increased 1% from the year-ago period and included a 1% unfavorable currency impact. Organic sales grew 2% on favorable volume and product mix.

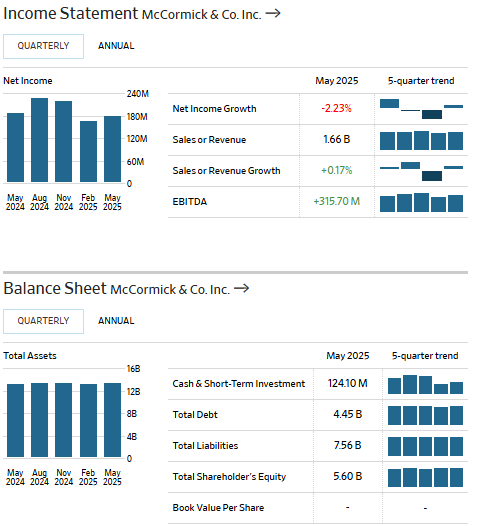

McCormick’s gross profit for the fiscal second quarter rose $3 million, reaching $622.8 million. The gross profit margin contracted 20 basis points (bps) to reach 37.5%, primarily due to increased costs associated with expanding capacity for growth and higher commodity prices.

The adjusted operating income increased 10%, totaling $259 million, with a 1% unfavorable impact from currency fluctuations. In constant currency, adjusted operating income increased 11%, largely due to lower selling, general and administrative (SG&A) expenses, driven by the timing shift of stock-based compensation expenses from the second quarter to the first quarter, along with ongoing cost savings from the CCI program, including SG&A streamlining initiatives. These gains were partially offset by lower gross margin, continued investment in brand marketing and higher technology spending.

Sales were $931 million, up 3% from the year-ago quarter’s level, with minimal impact from currency fluctuations. Organic sales advanced 3%, driven by favorable volume and product mix. Regionally, sales grew 2.4% in the Americas, 4.9% in EMEA and 2.9% in APAC. Our model expected Consumer sales of $918 million for the quarter.

McCormick exited the quarter with cash and cash equivalents of $124.1 million, long-term debt of $3,099.3 million and total shareholders’ equity of $5,630.4 million. In the six months ended May 31, 2025, net cash provided by operating activities was $161.4 million.

For fiscal 2025, the company anticipates strong cash flow, driven by profitability and working capital initiatives. In addition, it expects to return a significant portion of this cash flow to shareholders through dividends.

What to Expect From MKC in 2025?

McCormick’s fiscal 2025 outlook indicates its continued focus on strategic investments in key categories to strengthen volume trends and drive long-term profitable growth amid current uncertainty in the consumer and macroeconomic environment. The company’s CCI program remains a key driver of growth investments and operating margin expansion. In addition, McCormick expects foreign currency fluctuations to negatively impact sales and adjusted operating income by 1% each, as well as adjusted earnings per share (EPS) by 2%.

For fiscal 2025, management still expects net sales growth in the range of flat to increasing 2% (up 1-3% at constant currency). Sales are likely to be backed by volume-led growth across both company segments and a gradual improvement in China’s consumers.

It expects adjusted operating income to grow 3-5% and increase 4-6% at constant currency. Management envisions fiscal 2025 adjusted EPS in the band of $3.03-$3.08, which indicates a 3-5% increase from the year-ago period. On a constant currency basis, the adjusted EPS is expected to increase 5-7%. On a GAAP basis, McCormick projects fiscal 2025 earnings in the range of $2.98-$3.03 per share, indicating 2-4% year-over-year growth.