Berkshire Hathaway, under the stewardship of Warren Buffett, stands as a premier global conglomerate renowned for its disciplined capital allocation, long-term investment approach, and diversified business portfolio. This report provides a comprehensive analysis of its equity holdings, financial trends, and investment strategies, supported by key performance indicators and recent earnings data.

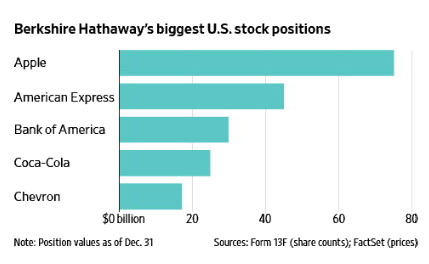

Largest U.S. Stock Holdings

As of December 31, Berkshire Hathaway’s five largest U.S. stock positions reflect its commitment to high-quality, fundamentally strong businesses:

- Apple (AAPL) – The dominant holding, reflecting strategic exposure to the technology sector and substantial cash flows.

- American Express (AXP) – A longstanding financial sector investment that aligns with Berkshire’s value investing philosophy.

- Bank of America (BAC) – A major banking institution providing stability and dividend income.

- Coca-Cola (KO) – A core consumer goods investment offering consistent cash flows.

- Chevron (CVX) – A key energy sector holding, ensuring portfolio diversification.

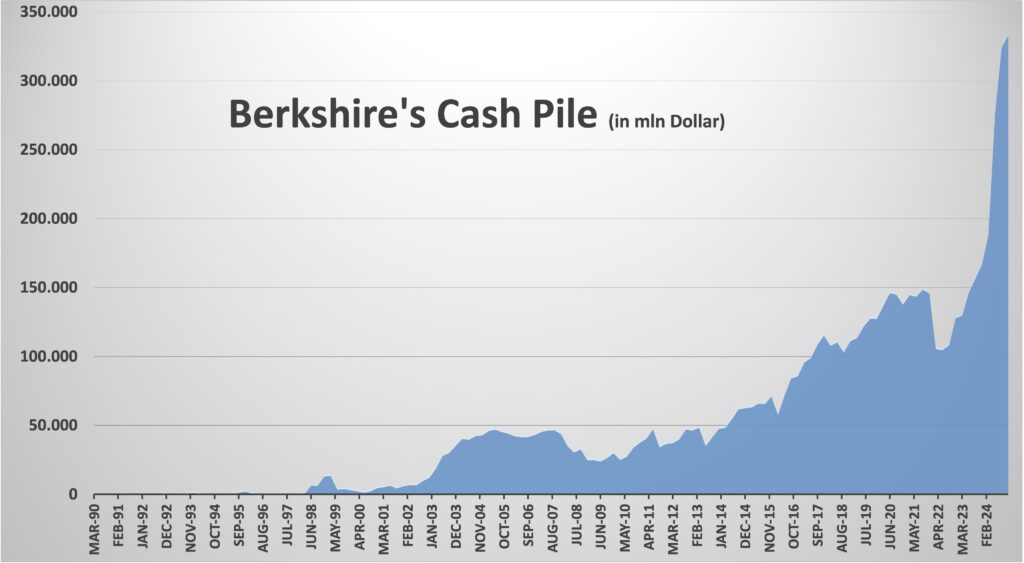

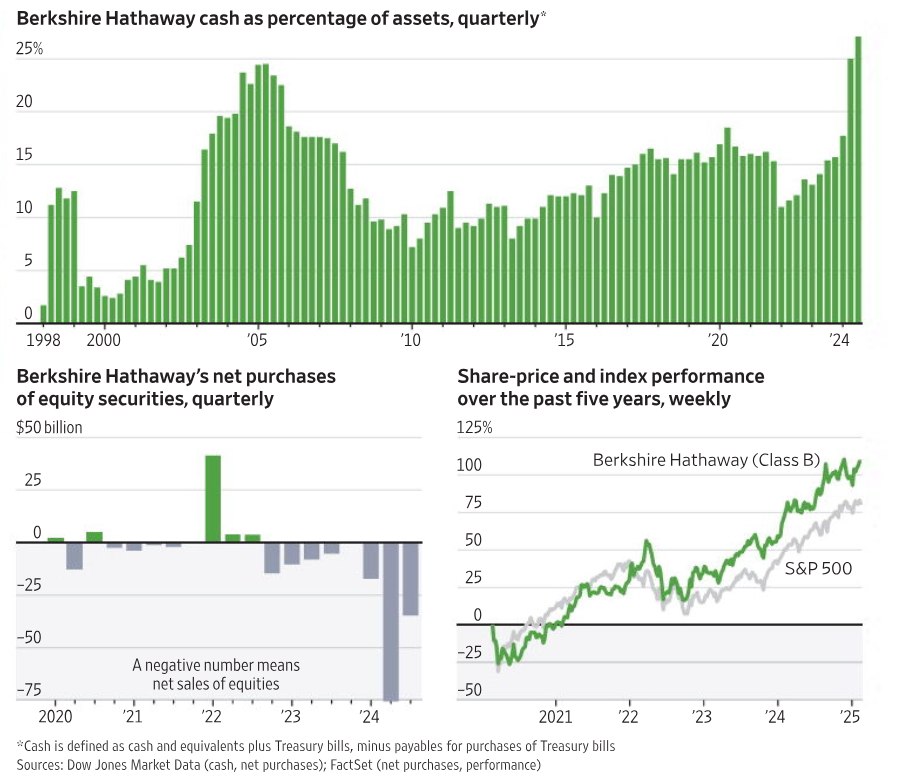

Capital Allocation & Cash Reserves Strategy

Berkshire Hathaway maintains substantial cash reserves to preserve financial flexibility and capitalize on opportunistic investments. Recent data indicates that cash holdings as a percentage of total assets have reached historical highs in 2024, suggesting a cautious stance in uncertain market conditions.

- Berkshire’s cash position has grown significantly, reflecting a conservative investment approach.

- Elevated cash reserves enhance Berkshire’s ability to deploy capital efficiently during market downturns or periods of dislocation.

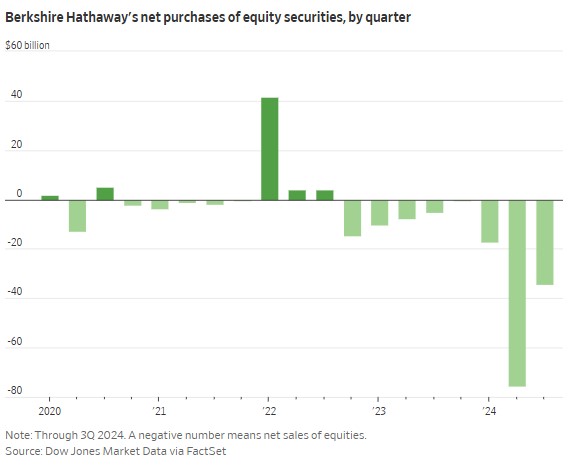

Equity Transactions: Net Purchases & Sales Trends

Berkshire Hathaway’s equity transactions fluctuate based on market conditions, valuation assessments, and economic outlook:

- 2022: A period of aggressive acquisitions, indicative of confidence in select valuations.

- 2023-2024: A strategic shift towards net equity sales, reflecting profit-taking and capital preservation.

Market Performance: Berkshire Hathaway vs. S&P 500

Berkshire Hathaway’s Class B shares have demonstrated consistent outperformance relative to the S&P 500 over the past five years:

- Superior risk-adjusted returns, underscoring strong capital allocation.

- Resilience during periods of economic uncertainty and market downturns.

- Sustained long-term capital appreciation benefiting investors.

Financial Performance & Latest Earnings Report

Berkshire Hathaway’s latest earnings report highlights robust financial performance across its operating businesses and investment portfolio:

- Operating Earnings: Reported at $14.5 billion, marking a 71% year-over-year increase, primarily driven by a $3.4 billion contribution from insurance underwriting (GEICO, Berkshire Hathaway Reinsurance Group).

- Revenue Growth: Strong contributions from BNSF Railway, Berkshire Hathaway Energy, and manufacturing businesses.

- Cash Reserves: Record cash holdings of $334.2 billion, reflecting a disciplined approach to capital allocation.

- Equity Transactions: The firm was a net seller of equities, strategically reallocating capital amid elevated market valuations.

- Stock Buybacks: Continuation of its share repurchase program, returning capital to shareholders while preserving intrinsic value.

Diversified Business Segments & Economic Resilience

Berkshire Hathaway operates across multiple industries, ensuring financial stability and risk mitigation:

- Insurance: GEICO, Berkshire Hathaway Reinsurance Group.

- Railroads: BNSF Railway, a crucial player in North American freight transportation.

- Energy: Berkshire Hathaway Energy, contributing to sustainable infrastructure.

- Manufacturing & Retail: Precision Castparts, Duracell, Dairy Queen, and others.

This diversified structure enhances revenue consistency and mitigates cyclical risks.

Warren Buffett’s Investment Philosophy: A Timeless Strategy

Berkshire Hathaway’s investment strategy, shaped by Warren Buffett’s principles, revolves around:

- Investing in high-quality businesses with durable competitive advantages.

- A long-term, fundamentals-driven approach over short-term speculation.

- Acquiring undervalued stocks with strong financial and operational performance.

- Maintaining financial prudence through disciplined capital allocation.

This approach has cemented Berkshire Hathaway’s status as a benchmark for value investing.