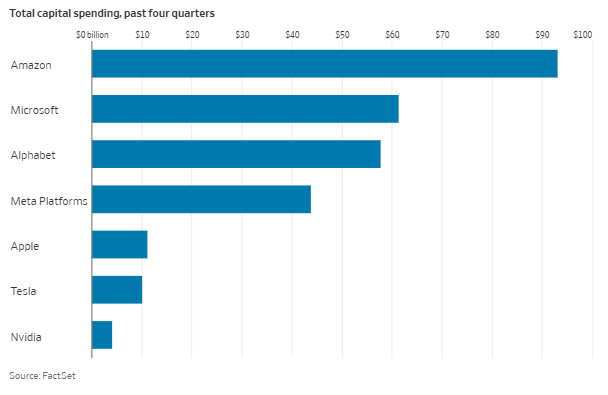

Capital spending, or capital expenditures (CapEx), refers to the funds that companies allocate for acquiring, upgrading, and maintaining physical assets such as property, technology infrastructure, and equipment. In the technology sector, capital spending plays a critical role in sustaining growth, improving competitiveness, and supporting innovations like artificial intelligence (AI), cloud computing, and semiconductor development. The chart provided highlights the total capital spending of major technology companies over the past four quarters, offering a clear picture of their investment priorities and strategies.

Amazon’s Dominance in Capital Spending

Amazon leads the group by a wide margin, with close to $100 billion in total capital spending. This massive investment is largely driven by the company’s cloud division, Amazon Web Services (AWS), and its vast logistics network. AWS requires constant investment in data centers, servers, and networking infrastructure to maintain leadership in the cloud computing market. At the same time, Amazon’s e-commerce business relies on continuous expansion and automation of its warehouses and delivery systems. Such heavy capital investment positions Amazon not only as a retail giant but also as a leader in global cloud services.

Microsoft, Alphabet, and Meta’s Strategic Investments

Microsoft, Alphabet (Google’s parent company), and Meta Platforms follow as significant spenders. Microsoft has invested heavily—over $60 billion—in cloud computing through Azure, AI development, and expanding its global data center network. Alphabet, with nearly $55 billion in spending, focuses on cloud services, AI-driven innovations, and hardware development. Meta Platforms, spending over $40 billion, has channeled much of its investment toward building infrastructure for its AI projects and ambitions in the metaverse. These companies demonstrate a shared strategic priority: advancing cloud technology and AI as the foundation for future growth.

The Rest of the Tech Leaders – Apple, Tesla, and Nvidia

Apple, Tesla, and Nvidia show comparatively modest capital expenditures. Apple’s spending, just over $10 billion, is notable for a company of its size. Much of this is allocated to supply chain infrastructure, semiconductor design, and product development, but Apple’s strategy tends to emphasize efficiency rather than heavy CapEx. Tesla, also at around $10 billion, focuses its investments on gigafactories, energy storage, and vehicle production capacity. Nvidia, with the smallest spending at under $10 billion, invests primarily in semiconductor design and research, with fabrication outsourced to partners like TSMC. Despite their lower CapEx compared to Amazon and Microsoft, these companies remain highly profitable, reflecting different strategic approaches.

Conclusion

The chart illustrates a clear divide in strategies: companies like Amazon, Microsoft, Alphabet, and Meta commit massive capital to scale infrastructure and dominate AI and cloud computing, while Apple, Tesla, and Nvidia maintain more targeted investments. These trends reflect the evolving priorities of the technology sector, where cloud services, artificial intelligence, and next-generation infrastructure are the battlegrounds for future dominance.