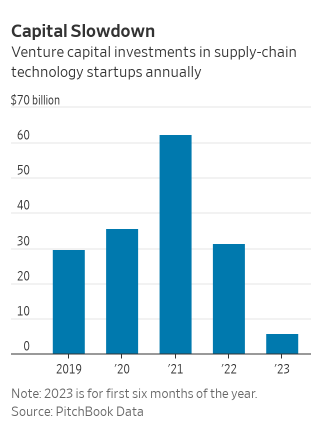

Venture-capital firms that once provided supply-chain technology startups with hefty backing at gaudy valuations have been tightening their pursestrings this year, pushing some of the businesses to slash costs, cut staff and look for other ways to survive in a weak freight market.

Venture firms concluded 404 deals totaling $5.7 billion for logistics companies in the first half of this year, down from 727 deals totaling $22.7 billion during the same period last year, according to PitchBook Data.

VC funding for the sector skyrocketed to a peak of more than $62 billion in 2021, according to PitchBook figures, as supply-chain disruptions during the Covid-19 pandemic put a spotlight on tech companies touting tools to help solve widespread shortages.

The pullback from investors has left some startups pinned between weak freight markets and a lack of capital as they approach the point when investors typically look for an exit around seven years in, experts say.

Venture funding helped subsidize many of the startups in their early years to help them offer lower prices to gain market share, said Julian Counihan, general partner at San Francisco-based investment firm Schematic Ventures.